Petrol's popularity dwindles as motorists embrace electric

Electric car registrations continued a run of very strong growth in June as consumers increasingly shun petrol and diesel in favour of hybrid and fully electric cars. Consumer demand continues to outstrip supply, with waiting times continuing to extend out to as much as 52 weeks for some electric models, due to the popularity of these vehicles.

Tesla continued to dominate in the first half of 2023, bagging 17% of electric car registrations in the first six months of the year. The brand experienced a very strong June, part of an even stronger second quarter, as was reported by the BBC, however the data shows that the UK saw particularly strong growth with registrations of Teslas doubling in Q2 2023 vs Q2 2022.

Kia and Hyundai are unexpectedly struggling to increase sales, despite being previously very popular brands.

⚡ What Our Data Shows

Ben Nelmes, Chief Executive at New AutoMotive, said:

"Electric cars are so popular that manufacturers cannot produce enough of them to meet demand. Consumers tell us they love the running cost savings, the smoother drive and guilt-free motoring. The challenge facing the

UK remains how to give consumers what they want: more electric cars.”

"Ministers' plans for a California-style Zero Emissions Vehicle mandate are essential to boosting the supply of electric cars as well as boosting charge point installations - but they must come into force in January 2024 so consumers can benefit. Petrol registrations are falling significantly, while diesel registrations are now a niche part of the market, as consumers are abandoning polluting vehicles faster than the government is planning to phase them out."

The full data release is available here.

📊 ZEV Mandate: State of the Market

We model how car and van companies would perform against the UK government's proposed Zero Emissions Vehicle Mandate targets. We compare sales in the last 12 months against the first target for 2024.

In 2024, car companies will have to ensure ensure that they have enough ZEV credits to cover 22% of their car sales and 10% of their van sales. We're tracking the overall availability of credits in the market as well as each brand's surplus or deficit of credits.

Overall market credit surplus/deficit: -44,000 credits

📌 Regional highlights

Just over half of all new cars registered in the Peterborough DVLA area in May were fully electric.

The Oxford DVLA area came in second place, with 48%. South West London (Wimbledon) is third, with over one third (38%) of all new registrations in the area being electric. One in four new registrations in Newcastle and Bristol were full electric. 9 out of the 46 regions in which we track new car sales had over 20% of new sales being fully electric in May. The top ten areas for EV registrations are now seeing an average of 8,000 electric cars roll off forecourts every month.

🚗 The race for EV market share

Electric cars continued a very strong run of growth in registrations in June, driven by running cost advantages and competitive leasing deals, even in a time of rising interest rates.

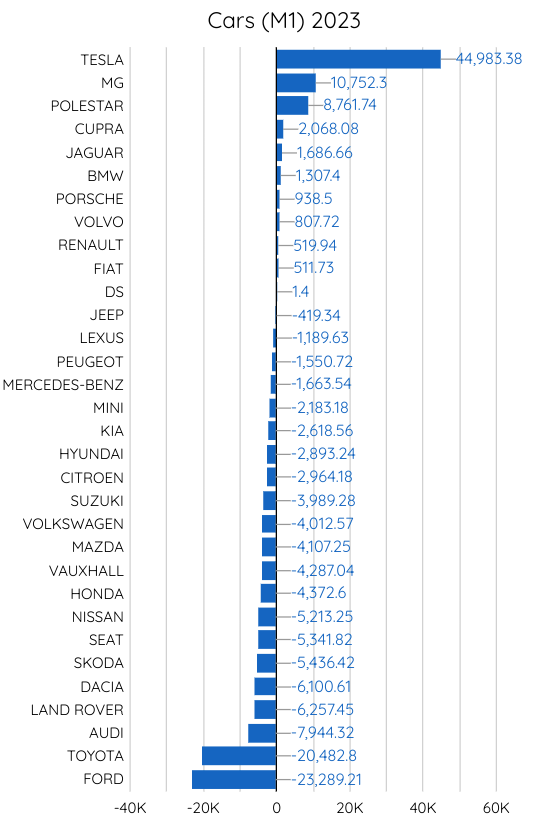

Tesla continued to dominate in the first half of 2023, bagging 17% of electric car registrations in the first six months of the year. The brand experienced a very strong June, part of an even stronger second quarter, as was reported by the BBC, however the data shows that the UK saw particularly strong growth with registrations of Teslas doubling in Q2 2023 vs Q2 2022.

Kia and Hyundai are unexpectedly struggling to increase sales, despite being previously very popular brands.

Chart: Most popular BEV brands, June 2023 vs 2022

About Electric Car Count

Electric Car Count is a monthly data series from New AutoMotive, a not-for-profit independent transport research organisation with a mission to accelerate and support the UK’s transition to electric vehicles. You can find out more about New AutoMotive by visiting www.newautomotive.org/mission

Electric Car Count provides an overview of the newly licensed passenger cars. It is released monthly, in the first few days of each month, providing data on the previous month’s newly licensed cars. In the UK, vehicles must be licensed (also known as registered) to be legally driven on UK roads.

We provide an overview of the state of the market, showing the number of cars registered by each manufacturer, broken down by fuel type. This provides a new way to track the transition to EVs in the UK.

Visit our interactive data dashboard here: www.newautomotive.org/ecc

For more background information on the statistics we provide, you can read our blog about the race for EV market share: www.newautomotive.org/blog/the-race-for-ev-market-share-is-under-way

Data sources & methodology

The data is shows the number of type M1 vehicles (i.e. passenger cars) in the DVLA’s vehicle licensing database as it stands on, or shortly after, the 1st day of the month. The DVLA’s vehicle licensing database is the legal record of all vehicles licensed for use in the UK. We obtain the data from the DVLA’s vehicle enquiry service API, and the DVSA’s MOT history API.

The data covers all cars with a standard form UK vehicle registration mark (VRM, i.e. the vehicle’s number plate), but does not capture any vehicles with personalised VRMs.

Terminology

We use the following terms to refer to vehicle fuel types:

Pure electric: battery electric, or other purely electric-powered vehicles (such as hydrogen). These are vehicles where the drivetrain of the vehicle is only electric, with no facility to drive using a fossil fuelled engine.

Hybrid: vehicles that have the ability to drive under electric power or under fossil fuel power. These include vehicles classified by the DVLA as “hybrid electric”, “electric diesel”, for example.

Q&A

Why are the numbers different from other organisations, such as the SMMT?

Our numbers are typically slightly different from those published by the SMMT. We cannot speculate as to why this is because the SMMT do not publish the methodology for obtaining their vehicle data.

Our data is based on the DVLA’s legal record of vehicles licensed as it stands on the first of the month.

Our methodology does not capture newly registered vehicles with a personalised number plate. These take longer to appear in our database, and are not included in the monthly release. We do not believe that these are a statistically significant part of the market.

Will you make this data open and accessible to more organisations?

Yes, we are happy to supply the data to anyone where doing so will not conflict with our mission. We encourage people to reach out to us on data@newautomotive.org.