Electric vans remain the preferred consumer choice when compared to hybrids.

While February 2023 was not a bumper month for electric van uptake compared to February last year, the market for e-vans remained stable at 5%. E-vans are still the second most popular choice for consumers, behind Diesel. If electric is to make up ground on diesels dominance of the market, the government must do more to ensure motorists are empowered to make the switch and access the running cost savings e-van offer.

⚡ What Our Data Shows

Ciara Cook, Research and Policy Officer at New AutoMotive, said:

“In the highly competitive new van market, diesel models continue to hold a firm grip, while electric vans are making steady inroads. However, despite the emergence of new hybrid models in the UK market over the past year, consumers are overwhelmingly rejecting them. We can see this reflected in the low registration numbers, which clearly indicate that businesses are not interested in hybrid vans.”

“The issue is that the upcoming Zero Emission Vehicle (ZEV) mandate has a target of 50% of the van market being fully electric by 2030. However, with diesel vans no longer being sold after 2030, this target implies that the other 50% of the market will need to come from hybrids. This is incredibly concerning given that our data shows businesses aren’t interested in purchasing hybrids. ”

“There is a pressing need for the government to address this issue and ensure that the mandate accurately reflects the consumer demand for electric vans. To achieve this, the government needs to increase the targets for electric van uptake which will provide a vote of confidence in this technology. Government should also offer grants to help the uptake of electric vans, which will give van drivers - as well as businesses that don’t like hybrid technology - an easier route to make the switch.”

The full data release is available here. You can view the data on our interactive dashboard, here.

📈 UK market overview

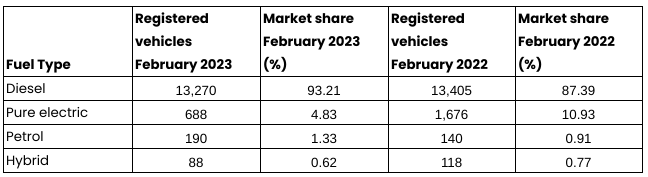

As expected diesel van registrations top the table, with 93% of registrations this month being diesel. Just over 13,000 new diesel vans were registered in February, and these will be polluting UK roads for the next decade. This dominance demonstrates just how far there is to go to reach zero diesel registrations by 2030. There was a slight contraction in the market overall this month compared to February 2022, and unfortunately this contraction disproportionately affected new e-van registrations.. February 2022 was an unusually strong month for e-vans, and the year-on-year decrease was to be expected. However, it is still important that we continue to monitor the market and that the government acts to ensure motorists are empowered to do the right thing and choose e-vans over their fossil fuel counterparts.

For the full data, and year-on-year comparisons, refer to table 1 in the full release.

🚗 The race for EV market share

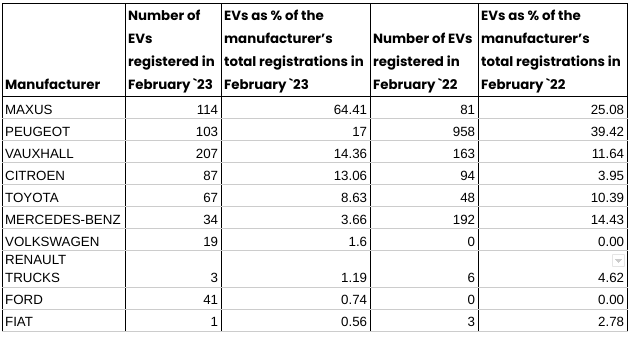

Vauxhall tops the table this month, with nearly one in three new e-van sales in February coming from this marque. Vauxhall are cementing themselves as an early leader in the electric segment of the van marking, and are proving very popular with business fleets. Coming in second is Maxus, another marque which is carving out a place for itself as a leader in the e-van market, with 17% of electric registrations belonging to the Chinese brand. The top five brands in this table account for 84% of electric vans sales this month, and those further down the table will need to act fast to ensure they gain traction in this market.

📊 The brands who are quickest to electrify

Maxus has topped this table since New AutoMotive began Electric Van Count in June last year, and continues to be much further ahead in its electrification journey than its competitors. 64% of their vans this month were electric, a considerable jump from 25% of their vehicles being electric in February 2022. The next closest competitor is Peugeot at 17% of their registrations being electric, a drop from last year. At the bottom of the table are Ford and Fiat with less than 1% of their registrations being electric.

We exclude brands that are 100% electric from this table since they do not need to electrify their sales. For the full data, refer to table 2 in the full release.

Notes

About Electric Van Count

Electric Van Count is a monthly data series from New AutoMotive, a not-for-profit independent transport research organisation with a mission to accelerate and support the UK’s transition to electric vehicles. You can find out more about New AutoMotive by visiting www.newautomotive.org/mission

Electric Van Count provides an overview of the newly licensed vans. It is released monthly, on the second Monday of each month, providing data on the previous month’s newly licensed vans. In the UK, vehicles must be licensed (also known as registered) to be legally driven on UK roads.

We provide an overview of the state of the market, showing the number of cars registered by each manufacturer, broken down by fuel type. This provides a new way to track the transition to Electric vans in the UK.

Visit our interactive data dashboard here: https://newautomotive.org/evc

For more background information on the statistics we provide, you can read our blog about the race for EV market share: www.newautomotive.org/blog/the-race-for-ev-market-share-is-under-way

Data sources & methodology

The data shows the number of type N1 vehicles (vehicles for the carriage of goods with a maximum mass not exceeding 3.5 tonnes) in the DVLA’s vehicle licensing database as it stands on, or shortly after, the 1st day of the month. The DVLA’s vehicle licensing database is the legal record of all vehicles licensed for use in the UK. We obtain the data from the DVLA’s vehicle enquiry service API, and the DVSA’s MOT history API.

The data covers all vans with a standard form UK vehicle registration mark (VRM, i.e. the vehicle’s number plate), but does not capture any vehicles with personalised VRMs.

Terminology

We use the following terms to refer to vehicle fuel types:

Pure electric: battery electric, or other purely electric-powered vehicles (such as hydrogen). These are vehicles where the drivetrain of the vehicle is only electric, with no facility to drive using a fossil fuelled engine.

Hybrid: vehicles that have the ability to drive under electric power or under fossil fuel power. These include vehicles classified by the DVLA as “hybrid electric”, “electric diesel”, for example.

Q&A

Why are the numbers different from other organisations, such as the SMMT?

Our numbers are typically slightly different from those published by the SMMT. We cannot speculate as to why this is because the SMMT do not publish the methodology for obtaining their vehicle data.

Our data is based on the DVLA’s legal record of vehicles licensed as it stands on the first of the month.

Our methodology does not capture newly registered vehicles with a personalised number plate. These take longer to appear in our database, and are not included in the monthly release. We do not believe that these are a statistically significant part of the market.

Will you make this data open and accessible to more organisations?

Yes, we are happy to supply the data to anyone where doing so will not conflict with our mission. We encourage people to reach out to us on data@newautomotive.org.